Table of Content

Peer-to-peer lending is growing in popularity, however that doesn’t mean it’s a pattern to jump on. Those “peers” aren’t doing this out of the goodness of their hearts. They’re running a small business that earnings from your monetary struggles. There are a few common causes individuals will think about taking out debt consolidation. The Federal Reserve continues to raise interest rates to highest-in-over-a-decade levels, in an effort to keep off the wallet-emptying effects of inflation.

With zero fees and customizable reimbursement terms, Marcus offers probably the greatest private loans for borrowers who wish to consolidate debt. Consolidating debt through a personal mortgage additionally lets debtors receive a lower interest rate while they pay again the mortgage, resulting in important cash being saved over the lifetime of the loan. It additionally estimates how much you'd spend on curiosity should you continued to pay down your debt in this method. Then, the calculator estimates your pay-down time and whole curiosity paid should you have been to get a debt consolidation mortgage with the estimated fee shown for the calculation. It is possible to consolidate many types of debt, however debt consolidation works best when it includes high-interest debt, similar to bank cards. The major attraction to debt consolidation is that you'll save money by paying a decrease interest rate.

What Kind Of Tax Debt Do You Have?

It's all about combining multiple, higher-interest balances into one loan, with one easy month-to-month cost. All loans, deposit products, and credit cards are offered or issued by Goldman Sachs Bank USA, Salt Lake City Branch. Over 44 million debtors owe $1.four trillion in scholar mortgage debt in 2017. Most of them may repay by consolidating their student loans. Debt consolidation could be difficult for people on a limited revenue. There must be room in your monthly finances for a payment that a minimum of trims the balance owed.

Once you’re permitted, you and the underwriter may even determine how the funds from the loan will be disbursed. Once you find a mortgage that matches your needs, you can apply for it through that lender. Your application shall be given to a loan underwriter who will approve your utility and work with you to finalize the loan. Whether you have poor credit or good credit, the basic loan buying course of is similar.

Kiss Debt Goodbye (for Actual)

Usually, people who find themselves looking at consolidation loans aren’t prepared to consider chapter. This sort of program works best for people who merely need a quicker, cheaper exit from debt and aren’t worried about their credit score score. You get out of debt for lower than the full amount you owe. In these circumstances, you might be better off with other debt reduction choices. If you have a retirement account, similar to a 401, you then could possibly use a 401 loan.

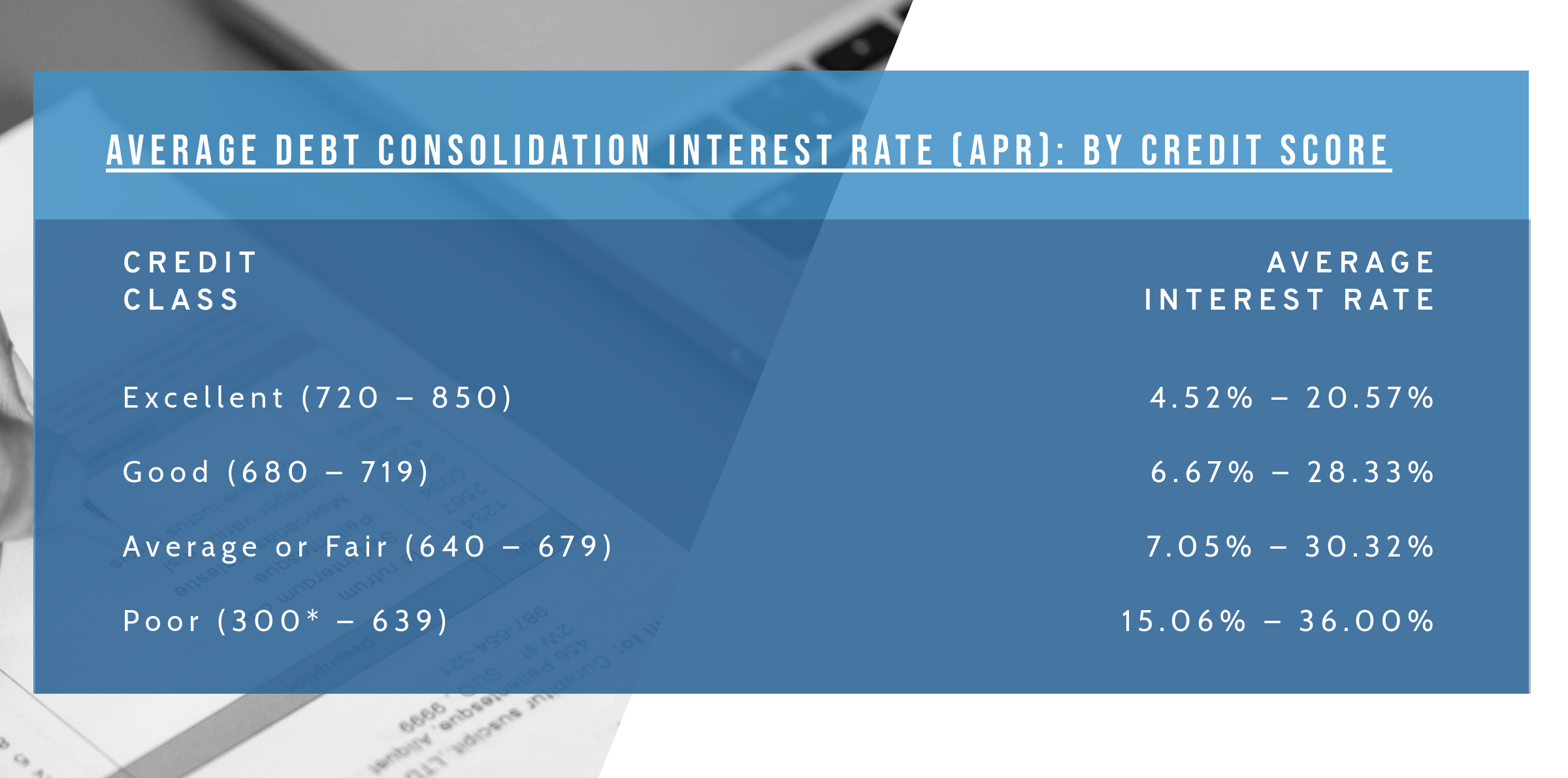

Your rate of interest might be decided based on your credit score score, credit history and revenue, as well as other factors like the mortgage's dimension and time period. Most loan phrases range anywhere from six months to seven years. When choosing your reimbursement terms, decide the month-to-month fee that matches greatest with your price range, but additionally observe how much interest you will pay over the lifetime of the mortgage.

Does Debt Consolidation Damage Your Credit Score?

It cannot be used to pay for post-secondary education, to pay off a secured mortgage, or to directly pay off a Discover bank card. The commonest forms of debt consolidated into a personal mortgage are bank card and retailer card debt. Secured loans, like residence and auto, can't be consolidated. Additionally, a Discover personal mortgage cannot be used to instantly pay off a Discover credit card. Your actual month-to-month cost could also be much less and your actual terms could also be longer on your Discover private loan. If you go with a debt consolidation loan, paying off all these money owed with a new loan, should improve your score virtually immediately.

You know precisely how much money you’ll must cover the cost in your price range every month. This may be helpful versus bank cards, where the payments can change. The 15 % equity contribution doesn't apply to money secured credit score facilities.” While there will be some exceptions to this, the Central Bank warned they aren't to become the norm. There are several places to hunt a consolidation mortgage, together with banks, credit score unions and on-line lenders. You can also see when you prequalify for a loan via LendingTree’s network of lenders using our private mortgage marketplace.

How Much Does Solar Mortgage Charge?

Loans are fully amortizing private loans as lengthy as you pay on time. You can review your price and monthly payment before you apply. If you might have fairness in your personal home – which means you owe lower than the house’s market value – you could usehome fairness for debt consolidation. Typically, banks allow you to borrow against 80% of the equity you have. So, if you have $50,000 in fairness, you could borrow $40,000 to pay off bank cards. You ought to pay significantly less curiosity than what you pay in your unsecured bank cards because you are providing your own home as collateral.

In others , the lender might require that they ship the funds directly to your collectors. However, if you’re in a monetary position that feels hopeless or overwhelming, it may be time to contemplate extra excessive measures. Credit counseling or even chapter can provide alternative debt options that could cope with an unmanageable monetary scenario. Getting out of debt when you've limited sources and unfavorable credit ratings can be tough. If you need to handle the process on your own, your greatest wager is to attempt to find ways to chop your bills, enhance your income or each.

There are some things to hold in mind earlier than taking out a mortgage, corresponding to how it may affect your credit score score. It’s important to know the process and what type of impact it could have on your credit rating. The quickest way to get out of debt is to get on a plan and stick to it. But before you see any life-change, you’ve got to decide it’s time to change the particular person within the mirror (that’s you!).

Debt relief is out there in many varieties, corresponding to credit counseling, debt settlement and bankruptcy. Many lenders let you prequalify for a personal loan to get an concept of your potential APR without impacting your credit score score. This lets you evaluate estimated mortgage offers earlier than you formally apply. Your APR would have to be lower than what you’re currently paying in your money owed for a private loan to be worthwhile.

No comments:

Post a Comment