Table of Content

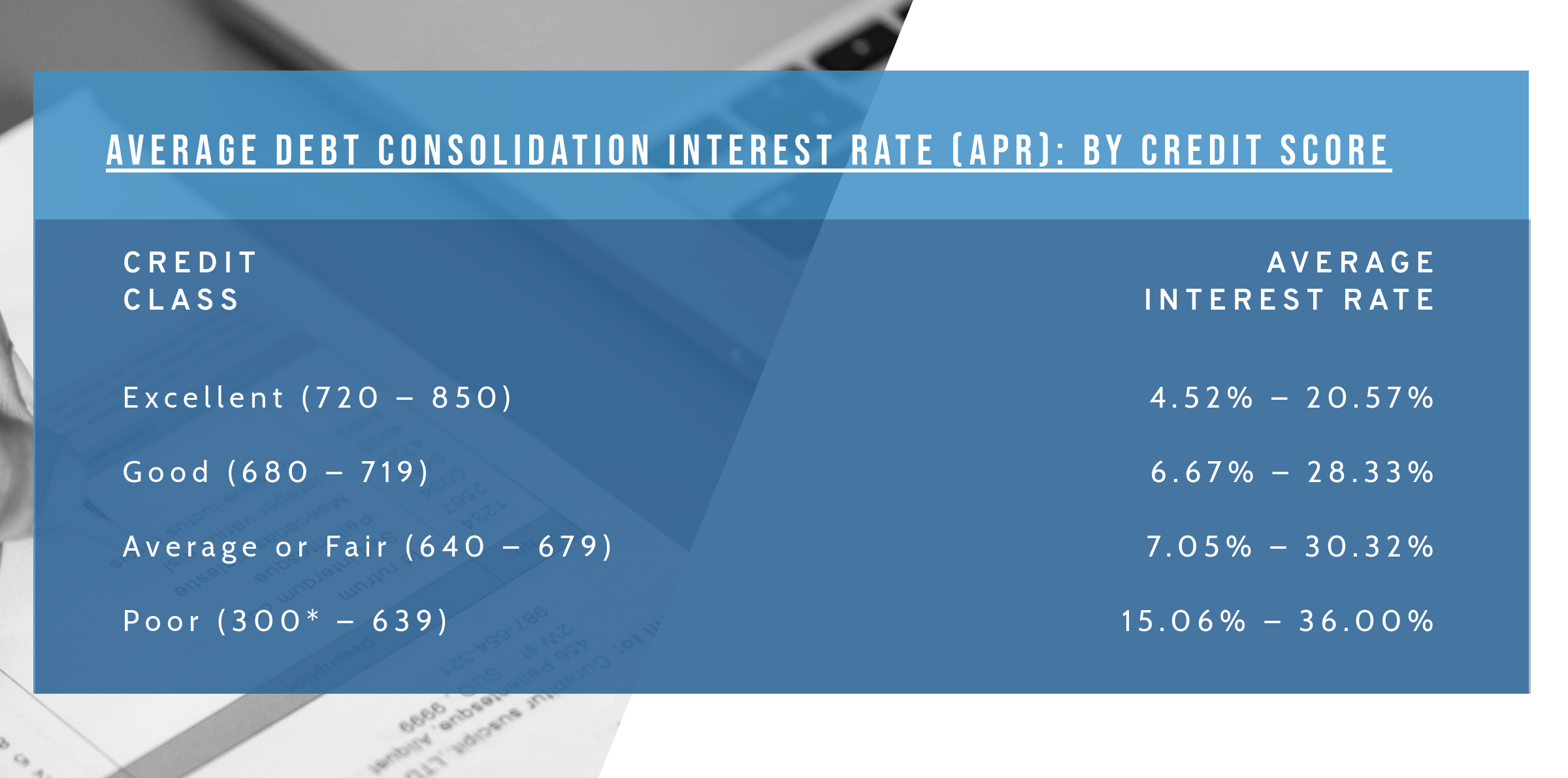

However, this debt reduction technique isn’t proper for everybody. And if you have unfavorable credit ratings, qualifying for a debt consolidation loan with a gorgeous rate of interest could presumably be a challenge. The aim of debt consolidation is to decrease the curiosity you’re paying, however there’s no guarantee you’ll get a decrease rate. “The objective of the loan is to pay less in curiosity, so when you have poor credit, you would possibly find yourself with a mortgage that has unfavorable phrases,” explains Tayne. You won’t be in a position to cowl the new monthly fee on your debt consolidation mortgage. A cash-out refinance occurs when a borrower refinances his mortgage for more than the outstanding steadiness of the loan.

You’ll additionally only pay curiosity on the quantity you borrow, not the complete accredited amount. If you have enough equity in your house, you can make the most of a house equity mortgage or home fairness line of credit score to help consolidate your debt. Because your home secures the loan, the lender can repossess your home should you fail to repay the loan. If you’re able to take management of your funds, debt consolidation may be an efficient approach to streamline funds and doubtlessly cut back your curiosity expenses. Sun Loan is a personal mortgage provider that has been in business since 1993.

Cons Of Debt Consolidation

You’re not able to take further steps to repay your money owed. You have a plan in place to keep away from running up your money owed again. Pay off the full amount of your mortgage , plus any applicable fees.

Some credit card providers offer cards that let you move—or transfer—existing bank card debt to a new card with a 0% introductory APR, usually for a small payment. As lengthy as you repay your debt inside the introductory period, sometimes up to 21 months, you'll be able to keep away from paying interest. Any unpaid balances after the introductory period ends will start to accrue curiosity. Consolidation loans have the potential to affect your credit rating in several ways. Applying for a mortgage requires a hard credit score examine, which might find yourself in a small dip in your credit score.

What Debt Are You Able To Consolidate?

There might be a small drop in your credit rating after consolidating debt, since you're taking out a new credit product or loan. You may additionally see a dip in your credit score rating should you settle a debt or work with a debt administration service. LendingTree is compensated by companies on this site and this compensation may impression how and where provides seems on this site . LendingTree doesn't embody all lenders, savings products, or loan options available in the marketplace.

We additionally checked out minimal credit score rating necessities, whether or not each lender accepts co-signers or joint purposes and the geographic availability of the lender. Finally, we evaluated the availability of each provider’s customer support team. Approved borrowers are rewarded with comparatively low APRs.

Unsecured Mortgage

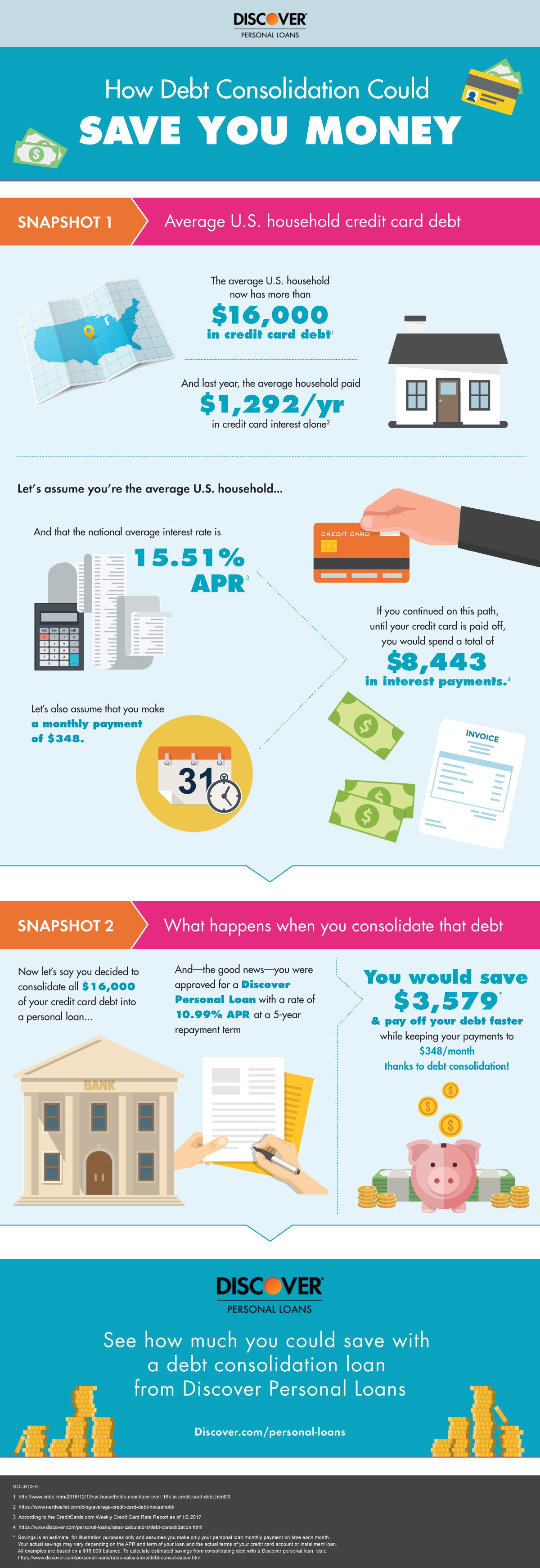

The lender or creditor will set your new interest rate relying on your previous cost conduct and credit score. And even should you qualify for a mortgage with low curiosity, there’s no guarantee your fee willstaylow. Debt consolidation loans usually include fees for loan set up, steadiness transfer, closing costs and even annual fees. Debt consolidation is the process of combining a quantity of debts into one month-to-month fee in a streamlined payoff plan.

Student loans are theonlykind of consolidation we will get behind—andonlyin particular circumstances. Use the calculator beneath to see whether or not or not it makes sense so that you simply can consolidate. Sign up for our newsletter to get the newest stories in hedge funds, PE, fintech, and banking — delivered day by day to your inbox. Click right here for extra information and to see if a debt-consolidation mortgage is right for you. Any curiosity and the time savings shown are solely estimates primarily based in your selected inputs and are for reference purposes only.

Alternatively, you may opt to take out a debt consolidation loan with an 8% APR—not 0%, but lower than your present rates. Select checked out charges, interest rates and versatile repayment options for various credit scores to search out the most effective personal loans for consolidating a quantity of money owed into one month-to-month cost. Different debt consolidation options come with their own set of rates of interest and charges. For instance, some private loan lenders charge origination charges, whereas a house fairness loan can incur appraisal fees and closing costs. Sifting by way of mortgage firms seeking a debt consolidation mortgage that provides competitive charges in your credit score rating can be time-consuming.

If you don’t have a private relationship with a lending establishment, one of the best thought is to name a nonprofit credit counseling company and converse with a licensed counselor. The nonprofit standing means counselors should present solutions which are in the customer’s finest interests, not the company’s backside line. If you attain the desperation point with bank card debt, one of two varieties ofdebt settlementmight be the answer to your drawback. If you use bank cards to pay for impulsive or extreme shopping (or both!), consolidation isn't a good option. Each bank card will have a different interest rate with a unique stability, so the quantity you actually are looking for is the weighted common rate of interest. Find an internet calculator and let it do the math for you.

Provide the lender with any documents or info it requests immediately to keep away from potential issues. Your credit score rating has improved since you took out your unique loans, so you’re likely to qualify for a more competitive interest rate. Debt consolidation might help you keep observe of funds, get a lower rate of interest and pay off your debt faster. It’s a smart move beneath the right circumstances, however you’ll want to weigh your choices to see if this is a good idea for your state of affairs. The common personal mortgage interest rate is presently 9.65% APR.

Additionally, customers have given the company a 1.5-star rating out of 5 stars. They have acquired a median of eight buyer evaluations and closed 28 complaints within the final three years. Making a few lifestyle changes can simply pad your wallet. And undoubtedly not some place else with a different rate of interest.Gone. There’s an enormous difference between debtconsolidationand debtsettlement. You provide a heck of lots of documentation about your debt, finances, identification, mortgage, and more.

This means the loan proceeds will be deposited to your checking account and you’ll have to repay your different lenders individually. The platform does supply customers numerous other perks and reductions, together with unemployment safety and the power to change their payment due date every year. Marcus additionally lets candidates prequalify with a soft credit score pull, so it’s simple to buy debt consolidation rates without hurting your credit.

The compensation schedule for a mortgage is determined by the situations of the loan and the amount borrowed. Once that debt is gone, take all the money you have been paying towards it and apply it to the second-smallest debt. No.This methodology comes with fees and an enormous spike in curiosity with any late payments—and it offers you one more bank card to worry about.

What’s more, borrowers should pay an origination fee between zero.99% and 5.99% of the mortgage quantity. This fee is a vital consideration when calculating how much you can save by consolidating your debts with a Best Egg personal loan. Borrowers can, nonetheless, pay off their loan early with out incurring a prepayment penalty.

No comments:

Post a Comment